Incentive Levers

Local and national taxation, modulations in product prices – such are examples of changes created by the zero waste trend. This trend means an adaptation of the economic signals sent to companies, local authorities and citizens in order to encourage virtuous behaviours or to punish any polluting treatment.

Increase the Cost of the Most Polluting Treatments

The use of polluting and unsustainable waste treatment methods is still massive in France. Each year, 18 million tonnes are sent to landfill, and nearly 14.5 million tonnes are incinerated. Despite the cost of investment and operation, these treatment methods are still too cheap to allow a massive shift towards waste prevention and recycling.

The French General Tax on Polluting Activities (TGAP) represents an underused lever. It is a tax that applies to each tonne of waste sent to landfill or incineration (see the Customs Code). The current low rates do not send a signal of change to communities and businesses. Moreover, the applicable « base rates » are in fact mitigated by numerous reductions, calculated according to the technical operating methods (energy recovery rates, pollutant thresholds, etc.), which allow tax reductions to be granted. For example, the basic rate applicable to waste incineration was € 12 per tonne in 2017: the cumulative reduction lowers this rate to € 3 for many incinerators!

Zero Waste France therefore recommends a gradual and substantial increase in the basic rates, as well as the concomitant abolition of the reductions that lower the tax rate on plants. In addition, there is an urgent need to reduce or phase out all other support mechanisms that benefit these facilities. Let us recall, for example, that incineration is – abusively, from our point of view – considered as a « renewable » energy at 50%, which allows certain heating networks to benefit from a reduced VAT rate. Energy produced by landfills and incinerators also benefits from preferential feed-in tariffs. Finally, refuse-derived fuel (RDF) are exempt from TGAP… Many expensive gifts that would be more usefully mobilised in favour of zero waste!

Encourage Waste Prevention and Sorting

While it is necessary to increase the cost of the most polluting treatment methods, it is also essential to support virtuous behaviours through tax incentives and tax adjustments (at local or national level). These modulations may concern certain consumption habits (repair, purchase of reusable objects, etc.) or more generally consist of a local public policy (incentive pricing for users, etc.).

Locally developing incentive pricing system

The French energy transition law for green growth of 17 August 2015 foreshadows that by 2025, 25 million of French should be concerned by an incentive pricing system of waste (5 million of inhabitants already benefit from it at this time). It’s a billing method in which part of the service paid by users is indexed on the amount of waste produced (measured in mass, volume, number of removal, etc.). Lots of studies regularly demonstrate the convincing results of this pricing system in terms of source reduction, improvement of recyclable refuse collection rates, better tapping in recycling centres, and especially significant reduction of residual household waste to be incinerated or to be landfilled. Coupled with the separate management of bio waste, such an incentive pricing system is a major lever for setting up a local strategy pushing towards the zero waste philosophy.

Promoting repair and re-employment at a national level

Lots of jobs could be created in the repair sector and re-employment sector, while contributing to lengthen products lifetime. Yet, these sectors struggle to grow or are even facing a crisis, even though they are a key element in the transition to a genuinely circular economy. High prices of certain repair processes in comparison to the price of goods, difficulties of re-employment sector to find property and take on people, etc… are as much statements for which solutions yet exist… To find a solution, Zero Waste France recommends the application of a reduced VAT rate on repair process, and the massive rallying of financing from Extended Producer Responsibility (EPR) sectors to re-employment. A reduced VAT rate could also be use in favour of communities which set up an incentive pricing system, or which collect separately organic waste.

Encouraging eco-designing

Plenty of products are nowadays conceived without taking into account their end-of-life: multi-materials wrapping, non-repairable electronic material, fragile or non-recyclable furniture, disruptive sorting inside clothing, use of dangerous chemical products… These are some of the many examples, sometimes well-known by the general public, in which the producer’s responsibility is obvious, since the lack of eco-design is so clear. Industrialists have to take action!

Several tools are already available but they are underused, such as the no-claims bonus system in the “Extended Producer Responsibility” (EPR) sectors. Lots of products are concerned by a EPR sector like wrapping, furniture, clothing, battery, etc. For each product brought on the market, producers of these goods pay an amount (an” eco-contribution”) to an eco-organization of which they are members. But these eco-organizations nowadays slow the placing of the no-claims bonus system on eco-design criteria of products. If a few bonuses are sometimes implemented, penalties are generally rejected even though eco-design problems are clearly identified in each sector. Zero Waste France recommends therefore a massive development of adjusted eco-contribution in accordance with the products design, by including substantial penalties. A particular display could if necessary inform consumers on products which received a bonus, or are targeted by a penalty.

Zero Waste at the scale of the territory : how to save money!

Local communities sometimes fear that a zero-waste policy will cost more than the status quo. If some initiatives may cause a temporary supplement, in reality the commitment to a zero-waste policy at a local level is the opportunity to redesign the public service’s structure, especially with the substitution of collections with less rounds for household refuse, and produce savings.

On the field, local communities whose residual household waste ratio by inhabitant is the lowest have generally less costs than other communities. In fact, residual household waste represents 40% of tonnage managed but 60% of costs: their decrease constituted a substantial saving from the moment this waste is not buried in landfill sites or incinerated. Furthermore, the rise of recycling rates also increases support from extended producer responsibility sectors (as for wrappings for example) and comes out of a reduced proportion from local taxes in the public service’s financing.

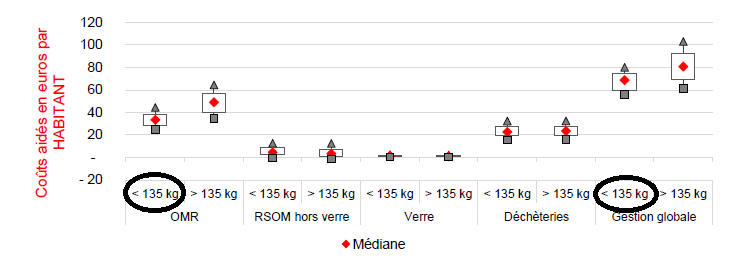

In his last national reference document of costs for 2014, issued in 2017, the Ademe dedicated a whole chapter to communities whose residual household waste ratio by inhabitants are low (less than 135 kg), and compared their costs to others communities. The figures speak for themselves: the zero-waste approach (left column for each category) is the winner at the budgetary level and the bill by inhabitant is lower than for the others !